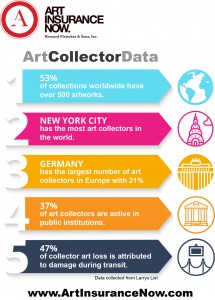

For many of us, amassing a robust collection of works by the artists we love is more a dream than a reality (though startups like Art Money are working to provide interest-free loans that should make buying art more manageable). But for emerging collectors and seasoned vets alike, the actual purchase of a piece is only the beginning of what it means to actually own art. Though not flashy, art insurance is a crucial part of collecting. It ensures that, should an artwork be damaged, it can be repaired or, in the case of a total loss, some kind of remuneration can be provided. So what do you need to know about art insurance? We sat down with Robert Pittinger, senior vice president and director of underwriting at AXA Art Americas Corporation, to get some helpful tips.

For many of us, amassing a robust collection of works by the artists we love is more a dream than a reality (though startups like Art Money are working to provide interest-free loans that should make buying art more manageable). But for emerging collectors and seasoned vets alike, the actual purchase of a piece is only the beginning of what it means to actually own art. Though not flashy, art insurance is a crucial part of collecting. It ensures that, should an artwork be damaged, it can be repaired or, in the case of a total loss, some kind of remuneration can be provided. So what do you need to know about art insurance? We sat down with Robert Pittinger, senior vice president and director of underwriting at AXA Art Americas Corporation, to get some helpful tips.

Know the Process

When a collector buys specialty art insurance, they’ll work directly with a broker who can assess the collection and determine what policy the collector might need. That broker, in turn, works directly with the insurance companies to find the right fit. A common misunderstanding of the process, Pittinger says, is that “collectors confuse the broker with the insurance company.” It’s helpful to know that “the role of the broker and the art insurer complement one another; however, the roles themselves vary and they are different. A specialized fine art broker is an advocate for the collector in seeking the best possible insurance terms for their clients.” As an insurer, AXA itself works with a select group of fine art brokers.

Keep Documentation

The first step toward getting insurance is—unsurprisingly—to determine what is going to be insured and for how much. To this end, documentation is key. “One of the biggest things is that the collector needs to have all the documentation for their collection before they go to the broker, because the broker has to have a very thorough understanding of the price of the collection,” Pittinger says. When approaching a broker, collectors should have a list of all the works, descriptions, invoices of sale prices, the purchase dates, and subsequent appraisal prices.“The collector’s management of their collection is critical, whether they have an online management system or a spreadsheet or they have manuals with all the documentation and their appraisals—that is a critical part of purchasing the insurance,” Pittinger says.

Assess Your Needs and Options

All this information is important to provide to the broker so they can determine what insurance is best for you. Though most collectors who need insurance already have it, some collectors think they’re covered by everyday, run-of-the-mill homeowners insurance. And they can be. But, as Pittinger notes, “A homeowner package policy generally is an add-on coverage. It doesn’t go into detail.” Homeowners insurance that covers art might have high deductibles, might not cover a collection across multiple houses, or might not cover the work during transit. That last one is a particularly sticky issue because “any time a collector moves their art, there is increased risk of damage,” Pittinger says. “That is the number one cause of loss for the insurance industry that specializes in art insurance.”

All this is why, for collections larger than just a few items, Pittinger recommends specialty art insurance. Even lower-priced works and emerging collections can receive insurance: For pieces priced as low as $2,500, AXA offers a 12-month policy of $75, with a minimum premium. Generally, however, it is hard to say exactly how much art insurance costs—it depends on too many factors. “Art insurance is very reasonably priced compared to other types of insurance,” Pittinger says. “The price range varies depending on the type of works, the size of the collection, security, where it is kept, if it is in a fine art storage warehouse or in their home or in a museum—all those factors go into pricing a fine art collection.”

Stay Up to Date and Be Careful

Broadly, in the event of damage, an insurance policy pays out in one of two ways: Either the policy will pay a set, agreed-upon amount determined by the insurer and the collector in advance, or the policy will pay out based on the work’s current market value. Pittinger says collectors opting for the predetermined payout structure may do so for a number of reasons, including peace of mind so that they “wouldn’t have to worry about substantiating the value of the works” in the case of damage. Agreed value can also move up and down over the life of a policy if the collector decides to get the work reassessed.

Current market value is exactly what it sounds like: The work is insured for its current value if that figure exceeds an agreed value. “But the important thing to remember is there would be a restriction—the company would by no means pay more than the total limit of the policy,” says Pittinger. In other words, if a collection is insured for $10 million total, and one work that has radically increased in value is damaged in excess of $10 million, the insurance would still not pay more than the total cap.

Be a Smart Buyer

One final note: Do your research. Make sure you get a full condition report prior to purchase. “It’s also critical that the collectors be careful with the provenance of the piece to make sure there’s not a gap in the ownership that could come back to haunt them later,” Pittinger says. If there is an issue and the work is seized for, say, having been looted by Nazis, insurance typically won’t cover that turn of events (there are, however, some specialty insurers that would protect against such loss with what is known as title insurance). So when it comes to art insurance, the old adage “buyer beware” certainly still applies.

—Isaac Kaplan

ARTSY EDITORIAL

BY ISAAC KAPLAN

NOV 11TH, 2016

For a quote apply here or call us at 800.921.1008

The transportation of art is a tricky thing, and as fine art transportation insurance leaders we can tell you exactly what you require to know so that your insurance program will be effective and cover you properly. Insurance coverage during

The transportation of art is a tricky thing, and as fine art transportation insurance leaders we can tell you exactly what you require to know so that your insurance program will be effective and cover you properly. Insurance coverage during